Last autumn, drivers across China staged a three-day strike against platform company Huolala from 16-18 November, resulting in the Ministry of Transport summoning companies and ensuring they better respect workers’ rights and not engage in unfair market practices. This swift government response to drivers’ online organization was a welcome step, but Huolala drivers again went on strike just half a year later, in May 2023, showing that conditions have not gotten better.

On 8 May, more than a hundred Huolala drivers in Chengdu, Sichuan province, went on strike and blocked the brick-and-mortar offices of the company. One driver compiled a list of grievances, explaining that unit prices were reduced four times consecutively to attract customers, which decreases drivers' income. At the same time, Huolala raised drivers’ membership fees and takes what drivers call an “unreasonable” percentage of their income.

After the Chengdu drivers went on strike, Huolala drivers across the country showed their support online, as also happened last November. Then, on 12 May, hundreds of Huolala drivers in nearby Chongqing participated in the strike, gathering in person and attracting the attention of the local police. On 26 May, in Liaocheng, Shandong province, dozens of Huolala drivers gathered to strike over their pay conditions.

Huolala’s business model extracts profit from drivers alone, rather than from a range of intermediaries

Huolala (Lalamove) is a platform freight company that allows customers to use an app to hire a driver and vehicle to move goods within a city or between cities in China. Huolala was founded in 2013 in Hong Kong and is considered a cargo version of online ride-hailing. Just like Didi or Uber, the platform uses algorithms to match customers with drivers. By 2020, Huolala’s market share in mainland China reached just shy of 55 percent, with no single competitor having more than 5.5 percent market share.

Huolala has recently applied for listing on the Hong Kong Stock Exchange. The company’s listing documents show that the company has turned from loss to profit through increasing driver commissions significantly over time. Unlike food delivery platforms - which charge intermediary fees from customers, restaurants and drivers alike - Huolala extracts revenue only from drivers. Huolala calls its combination of membership fee and platform commission a "mixed monetization model."

Photograph: TonyV3112 / Shutterstock.com

In addition, competition among the emerging freight platforms is growing, and this has resulted in Huolala’s sales and marketing expenses tripling to ensure it remains the leader. Ride-hailing platform Didi will launch Didi Freight, food delivery giant Meituan is planning a Zhoulu service, and delivery companies SF Express and JD.com also have freight plans.

For these reasons, Huolala’s business model and the recent changes to remain profitable have exacerbated conditions for platform drivers, leading to strikes and protests. Although there have been some government and corporate responses to the strikes, it has not been enough to ensure drivers are earning their fair share.

Drivers strike over platform management and algorithms that reduce earning power

Drivers are finding that they are making less income as Huolala expands. For example, one driver posted their recent experience of making a 60-kilometre round trip journey that was estimated to take 100 minutes, and the unit price was only about 60 yuan. This means that they earned just 1 yuan per kilometre, or an hourly income of about 36 yuan if the estimate is correct.

The driver appealed to others not to accept such orders:

Huolala drivers, can you stand up for yourselves? This kind of work takes at least two or three hours to complete, and it costs at least 20 yuan including petrol money. These kinds of trips mean that in one day, we can’t even earn 50 yuan. I’m at a loss to see why colleagues would yield to this platform designed to entrap drivers.

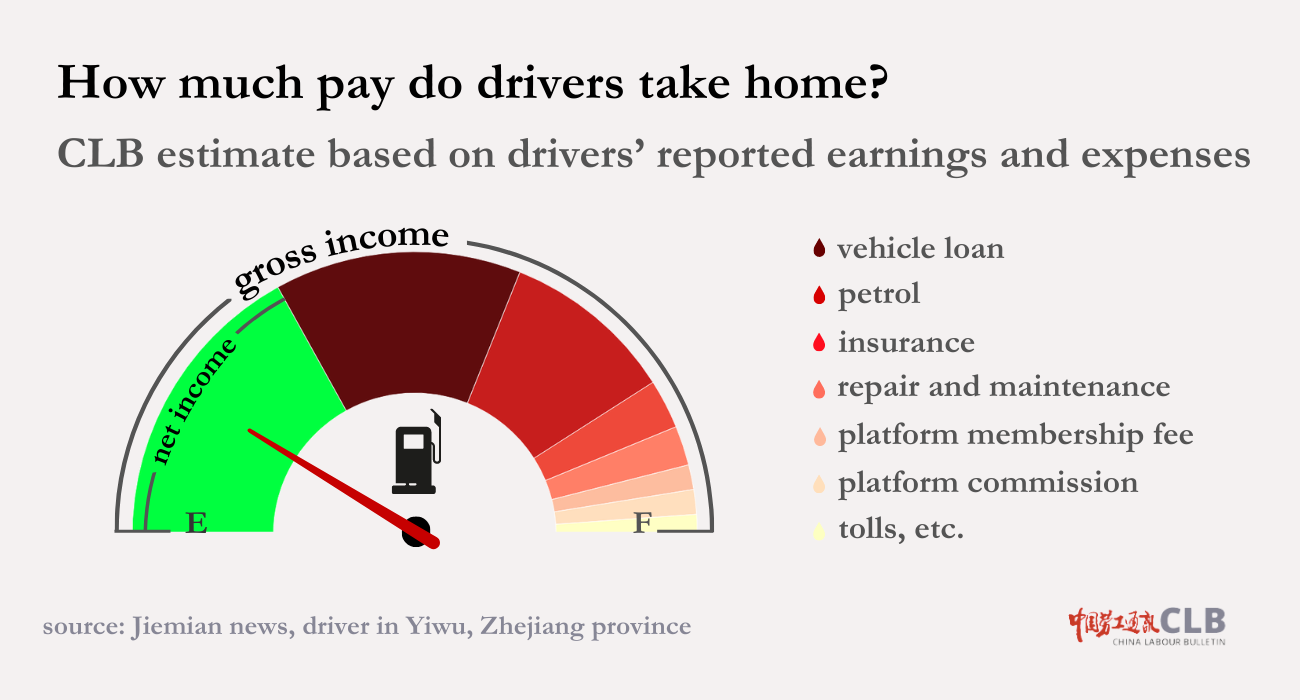

A driver working in Hangzhou said that from May to December 2022, his monthly net income was only about 5,000 yuan after deducting costs and fees.

Another driver, in Yiwu, Zhejiang province, told Jiemian News that in April 2022 he completed 172 orders with a gross income of 9,916 yuan. After deducting 2,883 yuan for petrol, a 609 yuan membership fee, and 395 yuan for vehicle repair and maintenance, his net income was only 6,029 yuan. This does not include the cost of insurance, or purchasing or leasing the vehicle.

The Yiwu driver said:

If it weren’t for the 1,000 yuan deposit, which there was no way to get back, I might have given up at that time.

A driver whose social media account name is “Expect Equality” detailed the 1,000 yuan deposit drivers pay to sign up, the monthly membership fee of several hundred yuan, and the seven to 17 percent commission of what the customer pays. His post about these methods to extract revenue from drivers receiving over 400 online comments.

The case of a truck driver who stabbed and killed Huolala staff after the company wouldn’t return his deposit shows the intensity of the problem. On 10 April, a driver in Guangdong province wanted to stop driving for Huolala and receive his 1,000 yuan deposit back. However, the Huolala staff refused to return his deposit, citing “company regulations.” The enraged driver stabbed two Huolala staff members and fled before being apprehended nearby.

After the incident, online criticism was pointed at Huolala for extracting income from drivers and refusing to return the deposit, leading to this extreme outcome. “Why can't the deposit be returned smoothly? The deposit is supposed to be refunded,” said one online commenter.

Regarding membership fees, initially drivers would belong to Level 1 or Level 2, with different driver benefits for each. In 2019, Huolala began to draw commissions from these members, and by 2021 the membership levels each had different commission rates. According to LatePost, Huolala changed its driver commission rules in September 2021. The company went from having a commission-free tier in 2019 to a 5, 8 and 11 percent commission for respective membership levels.

Have Huolala’s business practices changed after worker strikes and government intervention?

The 16-18 November 2022 nationwide strike by Huolala drivers was in large part over a new multi-factor ordering system on the platform. Single-priced orders of the past had displayed the total distance, but the new multi-factor orders launched in June 2022 take into account distance, road conditions and weather when determining the price of a trip.

The algorithm is opaque, but drivers overwhelmingly say that the multi-factor order system has reduced prices of trips, leading to lower income for drivers. For example, news reports show that last autumn, for some drivers, most trips available to accept were multi-factor orders, and they were suddenly earning hundreds or thousands of yuan less per day.

Photograph: WirestockCreators / Shutterstock.com

After the November 2022 strike and action by the Ministry of Transport - reprimanding Huolala and other platforms for “disrupting the order of fair market conditions” - Huolala announced that it would make platform adjustments to reduce the proportion of multi-factor orders. However, this has not resolved drivers’ grievances, as evidenced by the May 2023 strikes.

The driver posting under the “Expect Equality” username complained that the ordering system does not give drivers a sense of what level of effort is involved, or any control over their working conditions:

When you accept a trip, it doesn’t specify what kind of goods are involved. When you show up, there could be 1-2 tonnes of goods to move, and the rate is only about 20-something yuan. If you don’t do it, you will be dealt with because of complaints.

This problem has been exacerbated by Huolala’s market monopolisation, which has led to larger and more difficult trips over time. Some drivers have smaller vehicles, and demand for these services has become lower. A driver pointed out how the monopoly affects drivers’ ability to earn income:

What should someone do if they bought a vehicle without much cargo space? Now 80 percent of the freight market is monopolised by Huolala, so the only opportunity to get more pay is to survive through them, otherwise just sell your vehicle for scrap!

Huolala drivers involved in the Chengdu strike also expressed dissatisfaction online that the company does not offer adequate training - only a 30-minute safety video upon signing up - and that the company evades liability in the event of an accident.

Recent rise in protests shows strong need for worker representation

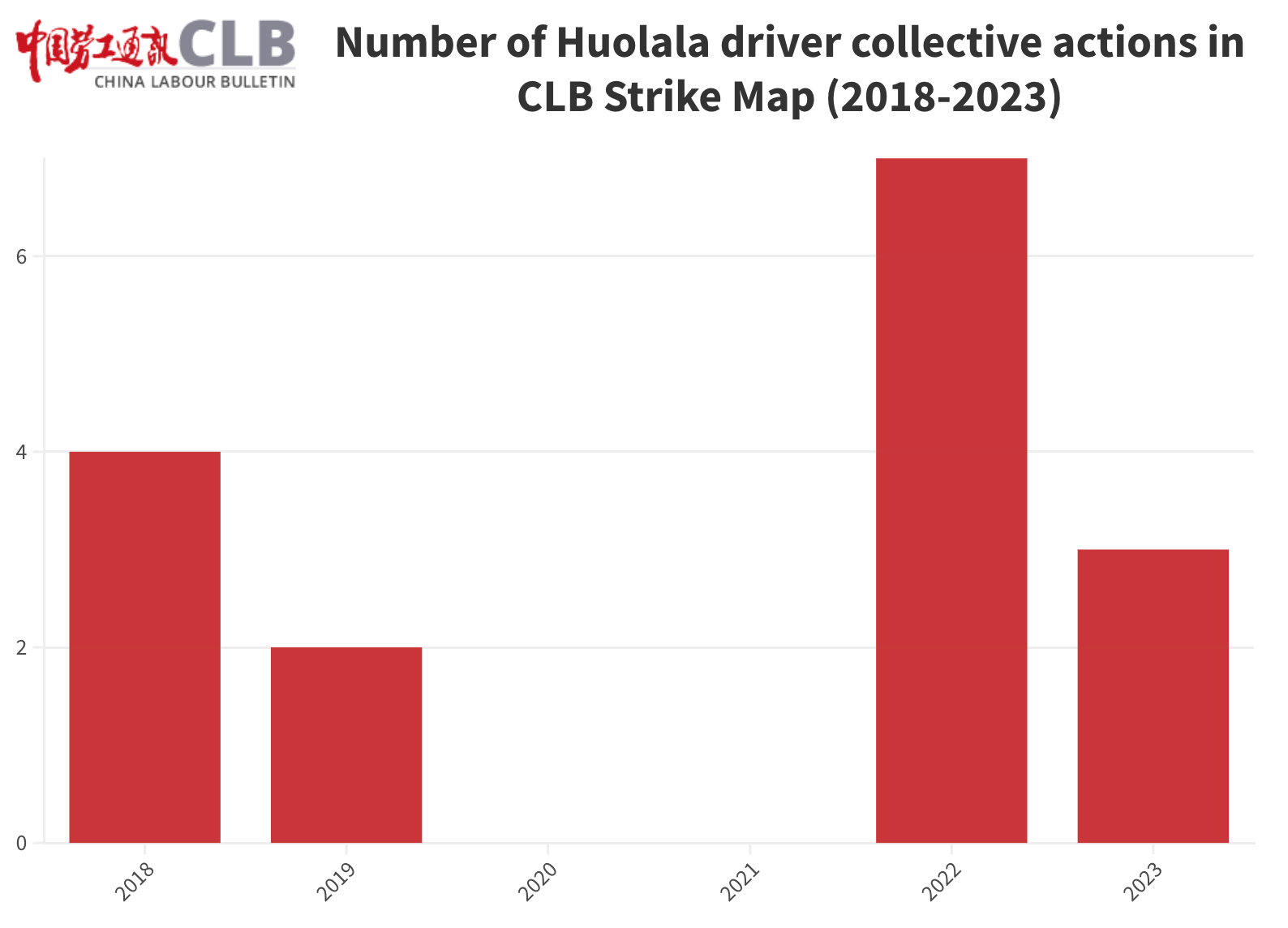

China Labour Bulletin’s Strike Map has collected 16 collective actions by Huolala drivers since 2018, with ten occurring since the end of 2022, showing an urgent need for worker representation.

Workers are up against an unclear and inhumane algorithm, a powerful company monopolising and setting standards in the industry, and a regulatory process that is at most a slap on the wrist. The warnings last November did not prevent Huolala from increasing the commission rate since then.

China’s official trade union, the All-China Federation of Trade Unions (ACFTU), has taken note of platform truck drivers as a special category of workers needing union representation. They are included in the union’s 2018 list of priorities, as one of the ACFTU’s “eight major groups” of workers, and the union has since launched efforts to bring platform workers into the union.

Provincial and regional unions have taken some concrete actions with regard to Huolala, specifically. In Shenzhen, the ACFTU established an enterprise union at Huolala. The enterprise union has taken steps to channel worker feedback through surveys, a hotline, WeChat groups, and other methods. However, the work of the union is focused mostly on driver rewards and subsidies, rather than the topics that are of most pressing concern to drivers: fundamental working conditions and transparent and fair pay systems.

In March 2023, in Shenzhen’s Futian district, the union organized an event to promote development of the Huolala enterprise union, identifying that there is a “bottleneck” in organizing workers in this sector:

The group is large and complex, the personnel are scattered, and management is difficult.

At the meeting, the Futian district union chair stressed that political and ideological work is the focus of the union. And in a five-point work plan laid out in a speech by the national-level ACFTU’s grassroots work department chair, the task of “unblocking the channels for workers to express their demands and improve the new employment form of workers” was listed very last.

Despite the existence of this enterprise union and coordination with it among the various levels of the ACFTU all the way up to the national level, what is missing is representation for workers on their key demand against the high membership rate and commission fees. The union could do a lot more to represent workers’ interests before the company and regulatory authorities.

CLB recommends that the enterprise union at Huolala work with ACFTU union structures to explore industry negotiations on topics such as how the mixed monetization model that Huolala uses to stay profitable is affecting workers, how the multi-factor order system is lowering drivers’ incomes, and whether the company could seek discounted vehicle insurance or other benefits that would ease workers’ financial burdens directly related to their work as platform drivers.

Worker organizing can be effective in pushing back against some corporate policies, but industry change may require union and government intervention

The brief strike by Huolala drivers in May 2023 did not change the company’s decision to slash prices to attract customers to the platform, at workers’ expense. But the collective action did spark lively discussions, according to videos posted online by drivers.

When some drivers made videos questioning whether the strike would be effective, rebuttals were promptly posted from supportive drivers:

The strike is still useful. The multi-factor system… was cancelled. Just because of the [November] 17th and 18th strike, it was cancelled after three days of suspension of work.

Despite limited space for organized actions by workers in China, platform drivers have organically responded online to support each other when facing conditions that affect their livelihoods. And their actions have shown that they have the power to reverse some of the company’s practices that lead to declining incomes. However, these reactive strikes have their limits. It would be difficult for drivers to fight for higher pay, for example, at least at the moment.

Platform companies’ business models are becoming unsustainable. They are in chronic deficit, since they invest heavily to fight off competition from others. Huolala is no exception. The company’s 2022 profits were 380 million yuan (U.S. $53.2 million), so based on the one million daily active drivers that year, each driver accounts for just 380 yuan of corporate profit. Huolala will likely continue to extract more value from drivers in order to recoup their investment costs and improve its earnings.

The drivers’ solidarity efforts online are a positive sign and show what kinds of organizing are possible. But to go further in this environment, workers will need the support of China’s official union to effect regulatory or administrative change.

Further CLB reading:

- Platform truck driver strikes across China result in some changed working conditions (December 2022)

- What You Need to Know About Workers in China: The Platform Economy (updated April 2023)

- China Labour Bulletin Strike Map data analysis: 2022 year in review for workers' rights (February 2023)